As I was looking over last month's apartment numbers, I realized there was a term on the financial statement that I never really paid much attention to and that some people might not have a good idea of the meaning of. I thought it might be worth explaining how the income portion of a financial statement is filled out and what each term means.

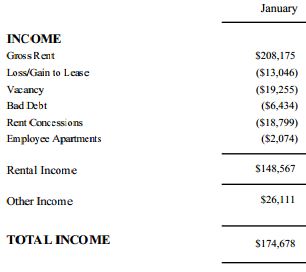

Below is the actual Income portion of the financial statement for the Houston apartment complex for January 2012.

Negative numbers are shown in parenthesis. Let's go over each term.

Gross Rent - This is the amount of rent that would be collected if every unit in the apartment was rented at market rates.

Loss/Gain to Lease - This is the term I figured some people might not know about. Apartments are typically rented out on a 1 year lease. Sometimes longer, sometimes shorter, but typically the tenant signs a contract to pay a certain amount of rent each month for a set number of months. Suppose a tenant signed a lease to pay rent of $500 per month for 1 year and that this is the typical rent for the area at the time of lease signing. Now suppose that after 6 months, due to improvements in the property, a stronger housing market in general, or other factors, the typical rent for a similar apartment in the area rises to $600. At that point, if a new tenant were to rent this apartment, management could charge $600, but since the existing tenant has a contract to pay only $500, the property is losing out on on $100 per month. This is known as "loss to lease" - We've lost $100 in income because the tenant has a 1 year lease preventing us from raising rents. The opposite also applies - if typical rents drop to $400, then we have a "gain to lease" of $100 per month because the tenant is paying $100 more than we could charge a new tenant.

Vacancy - This is pretty obvious. If an apartment is not rented, this is the amount of rent we are losing.

Bad Debt - Income we are owed, but have not been able to collect. For example, if a tenant bounces a check, that rent amount is bad debt (at least until it has been collected).

Rent Concessions - How much we give away in order to get tenants to sign leases. When you see advertisements for apartments that say "First month's rent free!", that is a rent concession and the amount of one month's rent would show up in this category.

Employee Apartments - Managers and / or other building employees sometimes live on site and, in exchange for their services, get either free or discounted rent. This line tracks this amount.

Notice that these amounts, even though they are negative, show up in the Income portion of the financial statement, not the Expenses section. This is because they are not actual amounts we have paid out. They represent reductions in the maximum possible income the property can achieve (as given in the first item, Gross Rents). The Expense portion of the financial statement only contains amount we have actually paid out.

So, as an investor, what you want to see when looking at a property's financial statement is the Gross Rent figure rising and the other figures decreasing (or getting closer to zero). In most cases, the monthly Gross Rent is typically assumed to be static for an entire year, even though market rents may vary month to month. This is just to make budgeting, reporting, and forecasting easier. However, if you are able to look at the financial statements of a property for multiple years, look for this number to be rising each year.

Loss / Gain to Lease is something you want to see approaching zero. A positive number ("gain to lease") is nice in the short term, but that would mean most of your leases are at above-market prices. In turn, that means tenants will probably be moving to a cheaper property when their leases are up and it may be hard to attract new tenants. Here is a chart of the monthly loss to lease numbers for my apartment for this year (through November):

Not too bad. Pretty big losses, but at least it's trending in the right direction.

I hope that gives you some insight into how to read the income portion of a financial statement for a rental property.

5 comments:

Most income property operating statements start with SCHEDULED gross income, not some "what if" amount that is not realizable. Yes, a deduction is made here for the difference berween market and actual rents, but using the market rent as the starting point inflates gross income and skews all the percentages. Unless income property analysis has changed over the last few years, this method is not standard and results in unreliable numbers for comparison purposes.

No bank is interested in this calculation of gross income. A lender, and the lender's appraiser, starts with scheduled gross income.

By definition, "market rents" are realizable. Scheduled gross income is "the theoretical maximum achievable annualized income assuming full rental occupancy." That is how I defined gross rent.

Scheduled gross income is contract rent, not market rent, for occupied units. If a tenant has a year left on a lease at $950, and market rent is $1,000, there is no value attributable to that extra $50 for that year. It is not "realizable."

Scheduled gross income is the maximum you can actually collect or "realize." That means the $950 contract rent on the unit leased at $950, not the $1,000 it would bring if leased today at market rent. From that you deduct vacancy and collection losses, and then all your operating expenses. That gets you to NOI.

The proper way to analyze the income is to consider the shape of the income stream in the capitalization rate in a direct capitalization (NOI/OAR). Once you get SGI down to NOI, then you adjust the capitalization rate to account for projected increases or decreases in contract rent at lease rollover. Or you can make specific rent projections in a DCF analysis.

If you were provided an appraisal of this property somewhere along the line, check the income approach calculations. If the appraiser did it the way that the GP did it in the report, I would be very surprised.

The top three google returns for "scheduled gross income" say that it is calculated based on 100% occupancy. So if you don't have 100% occupancy, then there is no contract rent to use in the calculation. It would make sense, therefore, to use market rent. But I see what you are saying for occupied units. It would seem that there are different ways to analyze the property. Your method would not use a "loss/gain to lease" figure, as that would play no role in determining NOI because your SGI is based on lease amounts. They way this management company is doing it appears to be the way I described. But I think the difference is semantic. If you calculate SGI based on a leased amount of $950 or calculate it based on a market rent of $1,000 with a -$50 loss to lease amount, you're ending up with the same figure.

I did get an appraisal and will try to dig it out and see how it was done.

You are correct in assuming vacant units are attributed market rent. PGI, or Potential Gross Income, is comprised of contract rents for occupied units and market rents for vacant units. I should have said PGI, not SGI. Most textbooks include rent for units occupied by managers.

Look at the Appraisal Institute textbook to see the commonly accepted method of analyzing income. It's the standard.

Consistency is desirable so comparisons between properties are meaningful. If you overestimate PGI, you will underestimate your operating expense percentage as a percentage of PGI and look like a better operator than you really are.

Post a Comment