Last week, I received a newsletter from Prosper that detailed some new features they have added to improve the site for lenders. These feature are:

- Additional credit data, including "current delinquencies" and "adverse public records" to assist lenders in verifying a borrower's stated credit history. This info is only visible to lenders.

- Special icons identify homeowners and borrowers with verified bank accounts. Personally, I find this last one somewhat pointless. Prosper verifies people's bank account anyway, which needs to be done because payments are made via automatic electronic withdrawals, so it seems to me like every borrower on Prosper will have a verified bank account.

- The number of listings a borrower has made in the past 30 days has been added. There has been some problems with people posting listings that are basically advertising - they have no intention of borrowing money and cancel the listing as soon as it has enough bids to fund. Since bidding ties up a lender's funds for the duration of the listing, people abusing the system like this are costing lenders money. This will help lenders avoid such people.

- Lender statements.

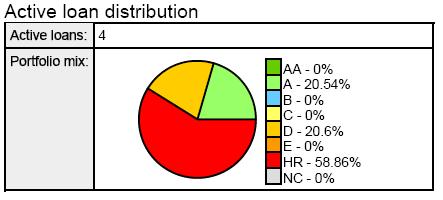

The one thing that is nice in the statement is a chart showing the allocation of your loans across the various credit ratings. Here's mine:

No comments:

Post a Comment