Things have picked up lately. After a period of low activity, it seems our borrowers are now once again buying properties. My partner has five loan requests to evaluate. Here are the details of the one I invested in.

This is a vacant single family home in Vallejo, California - in the San Francisco Bay area. It's a 1,310 3 bed, 2 bath home with an attached 2 car garage. It was built in 1994 and it sits on a lot just over 6,000 square feet. The front exterior of the property looks nice, although the back needs some work. Some landscaping needs to be done and, in fact, there were landscapers there working when my partner went to look at the property.

The borrower is our biggest borrower and he purchased the property for $141,000 at a foreclosure auction.The opening bid was $132,000, so others wanted this one as well. Zillow.com estimates the property to be worth $180,000. Based on MLS sales of comps, my partner estimates it to be worth $225,000 as-is and $265,000 after repairs. There are five good comps in the MLS. Four of them were short sales. Three of the five sold for more than the listing price. One of the comps is from May and the rest of 3 months old or less. All sold for higher than their Zillow.com "Zestimate." (Really, the only usefulness of their estimate, IMHO, is to get a ballpark figure of value. I'd never use it as a basis for REI analysis.)

My partner gives the neighborhood a not so good rating, but that normal for this borrower. He specializes in those areas. In terms of the loan, we are lending $105,000, giving us a 74.5% loan to value ratio using the auction buy price. Using our as-is estimate of $225,000, it's a LTV of 46.7%. The biggest drawback to this loan is that it is in an area we don't normally lend in and that our borrower doesn't usually buy in, meaning we could be off on our value estimates.

Here are some pictures.

Tuesday, December 17, 2013

HML #30 Started

Posted by

Shaun

at

2:01 PM

1 comments

![]()

Labels: Hard Money #30

Monday, December 09, 2013

Funny Article

I was reading some news stories that mentioned one of the REIT stocks I own, and came across this piece on The Motley Fool. Now, given the source, it's somewhat obvious that it will be biased towards stock ownership over rental property, but I thought it did provide a good example of what the typical first time landlord thinks - not too concerned with cashflow, relying on appreciating property values, no thought or budgeting towards maintenance costs, etc.

Posted by

Shaun

at

12:05 PM

2

comments

![]()

Thursday, December 05, 2013

Houston Apartment October 2013 Update

The numbers for October are in and things are still looking good. Occupancy remained at 94%. Rental income reached a high for the year, coming in $1,000 over September, which was the previous high for the year. Overall income dipped slightly due to some higher administrative expenses that consisted of once time charges. Year to date, the net income for the property is $100,000 over budget. (!)

As I mentioned before, the property is up for sale. I had a talk with the managing partner (of our investment group, not the property) a while ago and he mentioned that the property does need a little bit of work to bring it back up to being a highly desirable location for tenants (which isn't to say it's a pit right now). We did some renovation when we bought the property, but with the multi-year economic downturn, management didn't have the funds to keep adding amenities. As a result, at least one of the potential buyers we are talking to has indicated they plan to put about $1 million into improvements if they end up as the owners. That's good news for the tenants. Of course, now that the property is performing well, we have the option to not sell the property and invest in making improvements ourselves. However, that would require raising additional capital from the owners (us) and our managing partner told me he spoke with the largest shareholders in the property and they did not want to invest any more money. So the property is up for sale. I can't really blame them. I also miss getting the quarterly distribution checks and can understand wanting to get back into something that produces income on a regular basis.

Posted by

Shaun

at

12:41 PM

0

comments

![]()

Labels: Multi #1

Monday, November 18, 2013

HML #29 Started

My partner found another deal to loan on and my funds from HML #25 and #26 are being used to help fund this one.

This property is a nicer one than I normally lend on, although after looking at the photos below, you may think otherwise. The biggest difference is this property is in a fairly nice location and is surrounded by homes in the $1 million and higher range in the city of Orinda, California. Our borrower also is buying this house through a Realtor, rather than at an auction, where most of the properties we lend on normally are purchased. The buyer is also paying an assignment fee, meaning she found this property with the help of a bird dog.

The property is a single family home (2/1) with an attached two car garage. It was built in 1951 and is about 1400 square feet. Here are some pictures:

The interior looks like it still has the original fixtures, tile, etc. It will need extensive remodeling to bring it up to the standard of the neighboring houses. (Those were also built in the 1950's, but interior photos of comps on the MLS show completely re-done and very modern looking interiors.) Externally, there are several issues - termite tubes have been found in the crawlspace under the house, there are some cracks seen in the foundation, and there are some drainage issues with the slope of the landscaping. The buyer had a professional property inspection performed, which I have a copy of. Besides the previously mentioned issues, an electrician will likely need to be brought in to re-wire pretty much the whole house. There are no GFCI circuits (they didn't exist when the house was built), the breaker box is a 50 amp circuit and not the standard 100 amp used today, and there were several places where the ground circuit was either non-existent or poorly wired. The roof appears to be OK, although it needs to be cleared of some debris. Rain gutters need to be removed or re-hung. There is a porch that is practically falling down that will probably also have to be removed. Based on the inspector's report, I would estimate between $50,000 and $75,000 in repairs are needed. But that's based on Arizona costs. I don't know what they would run in California.

The buyer is purchasing the house for $520,000 plus a bird dog fee. We estimate the current as-is value to be $600,000. Our loan will be for $460,000. Based on comps, we estimate the after repaired value to be at least $825,000. Given the good neighborhood (three comps describe the neighborhood as "coveted", "premier", and "desirable" - all written by different agents at different agencies) and the large amount of equity, my partner rates this as one of the top 10 safest deals he has done, out of close to 200 total. The borrower is our second largest borrower and the loan will be personally guaranteed. She has always paid promptly in the past and has been rehabbing property for at least 5 years (although we've only worked with her for 2 years). The drawbacks: this is the smallest property of the comps we looked at, so the comps may not be truly representative of the property's value. However, they are all we have to go on. The other big drawback, of course, is the condition of the property. It needs a lot of work. If we have to take this one back from the borrower, we will have some serious work to do if we want to fix and sell.

Posted by

Shaun

at

10:39 AM

1 comments

![]()

Labels: Hard Money #29

Monday, November 04, 2013

Houston Apartment Up For Sale

I received word this weekend that the Houston apartment complex is up for sale. In fact, we already have two offers for it. Unfortunately, I'm not allowed to discuss any details at this time, but after any sale completes, I'll talk about them. The property was just appraised at between $13.2 million and $14.5 million. We bought it for around $12 million back in 2008.

Posted by

Shaun

at

9:53 AM

0

comments

![]()

Labels: Multi #1

Wednesday, October 30, 2013

Apartment September Numbers And HML #28 Pay Off Delay

September saw a continuation of the good performance of the Houston apartment complex. Rental income (which excludes utility chargeback amounts) reached its highest level to date - $170,000. Total income was just $1,000 lower than last month at $198,000. Net income (cash flow) for the month was $19,000, a bit lower than last month's record setting $25,000. I don't really have anything else to report on this other than rent concessions dropped by $1,500 and bad debit write-offs dropped by $5,000. Both of these are good things.

I reported last time that HML #28 was paid off. I was a bit premature on that one. It was supposed to be paid off on Oct. 18, but escrow did not close then. In fact, escrow still hasn't closed and we are now looking at this Friday to be the new closing date. No word on the reason for the delay, but given the unusual demands by the title company (like requiring a signature from me, a mortgage holder), I would not be surprised if they were the reason for the delay.

Update: Turns out, the delay was because the buyer had a scheduled vacation and was out of town. Escrow is closing today, although not without some additional drama. The title company was saying they would not release the funds to my partner and needed wiring instructions from me so they could wire the funds directly to my account. I was off getting that info when I got another call from my partner saying the title company changed their mind and was ok with simply cutting a check to me and letting my partner mail it to me. So that's what we are going to do.

Posted by

Shaun

at

7:19 AM

0

comments

![]()

Labels: Hard Money #28, Multi #1

Wednesday, October 23, 2013

HML #28 Paid Off And Looking Towards 2014

HML #28 was paid off on Friday. This loan was started just a few months ago in August and, at the time, we knew it was going to be a short loan. Out biggest borrower is not buying much these days because he feels people are paying too much at the foreclosure auctions. As a result, my partner has $1.2 million sitting around waiting to be re-invested and where I normally have four loans outstanding at any one time, I currently only have one.

This payoff was also strange in that this was the first time in the 7 or 8 years I have been doing this that I was required to go to the title agency and sign documents. As a mortgage holder that is being paid off, there isn't anything I normally have to sign and for those few things that do require a signature, my partner and I have a loan servicing agreement that gives him permission to act on my behalf. However, this particular title company was very picky and didn't want to accept that document, so I had to rush around a bit last week to locate a local branch of the title company, sign some documents and have them overnighted to the closing title company in California.

I've been thinking about the Houston apartment lately. The property is performing nicely now and I think management will look at putting the property up for sale near the end of the year or beginning of next year. Investors were guaranteed at least a 9% annualized return and the last time we received a profit distribution was October of 2009, so a sale would give us 4 years of accrued interest plus our share of whatever profit we make from the sale over our purchase price.

I'm trying to plan how to reinvest my money once this investment is over. (I know, I'm counting my chickens before they hatch.) I'm not sure I want to reinvest in an apartment complex right now. I do like the idea of apartment investing and plan to do it again in the future, but I'm not sure it's the next investment I want to make. For one, it's become clear that the performance of apartments is closely tied to the economic situation of the area. That's obvious and holds true for any real estate investment, but what this investment has shown me is that, because apartments have many tenants, a widespread economic downturn can result in the loss of many tenants. That can cause a cascade effect where property income drops and operating expenses don't get paid and investors can't get scheduled distributions.

Which brings me to my second point: apartments really are a business. They have operating expenses that have to be paid and maintenance and other activities to manage. As an investor, I didn't really have to deal with the day to day administration of such things because we have a management team that handles that. However, as was the case with this property, if things go downhill for a while, investors may be asked to contribute more money to help keep the business afloat. This is in contrast to investing money in a mortgage, where someone just sends you a check every month and a call for more money would be very rare. True, you may have to foreclose and then the mortgage investment can become like a business in that you'll have expenses like fix up and repair costs to sell the property. But on the whole, I think mortgage investing is a lot more hands-off than apartment investing. It also seems the cash flow is more stable, although that may just be due to the quality of the borrowers my partner deals with.

Overall, I think apartments tend to be more of an investment for those looking to get capital gains rather than monthly cashflow. I'm reasonably sure that, had I made this investment in a strong economy and did not have to suffer through 4 years of no cash flow, I would have a different opinion. In a strong economy, apartments probably do provide a robust cash flow. However, at this point in my investing career, I'm more interested in dependable cash flow than capital gains, so I'm leaning towards reinvesting these funds into hard money loans.

Posted by

Shaun

at

10:20 AM

3

comments

![]()

Labels: Hard Money #28, Multi #1

Tuesday, October 01, 2013

August 2013 Apartment Numbers

The results for August for the Houston apartment complex have just come in from the management company and things continue to go well. Occupancy stayed at 94%, the same as July, but total revenue increased to $199,600. Net operating income hit almost $94,000, which was almost $4,000 higher than July. Cash flow for August also increased just a bit over $25,000, also an increase over July. This is the highest monthly cash flow number this year.

Expenses were normal with the exception of a one time $4,000 expense for tree trimming that was required by our lender. Our losses due to bad debt, which had ballooned to over $22,000 last month, dropped back down to just under $10,000, which is still higher than average, but at least it's moving in the right direction. Rent concessions almost doubled from last month. Since occupancy stayed the same, it looks like my predictions of a stronger rental market last month might have been a bit off.

Nevertheless, the property is performing nicely now and our net income figure is about $14,000 higher than budgeted for the year. Management hasn't made any mention of it yet, but I think the property is beginning to look like it might be in shape to be put on the market towards the end of the year.

Posted by

Shaun

at

12:30 PM

0

comments

![]()

Labels: Multi #1

Monday, September 30, 2013

Two Loans Closed

My hard money loans numbers 25 and 26 have been paid off. Both of these loans went the full 1 year term. The borrower has paid off the loans, but I'm not sure if it was from selling the properties or from refinancing them to convention mortgages.

Things seem to be slowing down. My partner manages about $6 million in hard money loans and he currently has close to $1 million sitting around waiting to be invested. Our biggest borrower is not borrowing as much as he used to. He thinks people are paying too much for foreclosures these days. Because he specializes in bad neighborhoods, he wants to make sure he doesn't overpay, so he's becoming more selective about the properties he buys. Also, the inventory of foreclosures is starting to shrink a bit.

Posted by

Shaun

at

3:23 PM

0

comments

![]()

Labels: Hard Money #25, Hard Money #26

Wednesday, September 04, 2013

July 2013 Apartment Update

The numbers for July are in and things continue to improve. Occupancy is at 94%, a 2% drop over June,

but total income for the month rose to the highest level of the year,

just shy of $197,000. Expenses rose by about $2,000, but the increased

income more than made up for it. Total Net Operating Income for the

month was just under $90,000 and Net Income (i.e. cashflow) was about

$24,000 - both of which were the highest for the year. The cashflow amount was up about $4,000 over last month.

Management

is touting the trend of increasing profitability, of course. Our Net

Operating Income is the highest it's been since 2009. But looking at the

figures, I'm a bit skeptical as to if the improvement will continue or

even stabilize. Compared to last month's numbers, I notice a couple of

things:

- The Bad Debt loss doubled from $11,000 to $22,000.

- Rent concessions decreased from $8,000 to $6,000.

- Other Income increased from $27,000 to $40,000.

- Apartment Turnover costs rose from $3,000 to $4,000.

- Property taxes increased by $2,000.

If we look at the numbers, we might be able to read between the lines and get an idea of what is going on at the property. Rent concessions decreased. That points to a stronger rental environment. Bad debt, apartment turnover costs, and income from lease buyouts rose. Those items points to non-paying tenants moving out, either on their own or due to management becoming more diligent in enforcing leases. The occupancy dipped slightly, so that also supports this outlook. I would guess management is seeing more desirable potential tenants becoming available as the rental market strengthens and they are stepping up their efforts to replace unprofitable tenants with profitable ones.

At least, that's my take on it.

Posted by

Shaun

at

2:33 PM

1 comments

![]()

Labels: Multi #1

Tuesday, August 13, 2013

Hard Money Loan #28 Started

The funds from my last loan that closed have been reinvested. This one is a single family home in San Pablo, CA. It's not in the best neighborhood, but the house itself isn't too bad.

The house was bought at auction for $151,000. Our loan is for $94,500, giving us a 62% loan to value ratio. The buyer plans to put $20,000 in remodel work into the property. We estimate the after repair value to be $190,000.

The property is a 1,050 square foot single family home, 4 bedroom, 2 bath. It was built in 1954 and has a single car garage. It sits on a 5,800 square foot lot. Behind the house is a raised train track and beyond that is the San Pablo Bay. Comps sold for between $160,000 and $170,000 within the past year. The $160,000 comp sold in one day and the $170,000 one sold in less than 1 month. There was only one other home recently for sale and it also sold very quickly. As a result, our borrower is going to try to get top dollar and will list it for $225,000.

The pros of this deal are:

- It's a short duration. The rehab is mostly done.

- There were multiple bids at auction for this property, meaing other investors thought it was a good deal.

- The area is a seller's market right now.

- The LTV is 62% - much better than our normal 75%.

- Elevated train track behind the house. Could be very loud, but the borrower says inside it isn't bad.

- Not the best neighborhood.

This loan is going to be a very short duration. The borrower did not ask for a loan until about 1.5 months after he purchased the property. (He needs funds now to move on to another property.) The rehab work has now been completed and the property should be listed in about 7 days. The borrower put in a new water heater, carpet, and garage door, along with other miscellaneous items.

The borrower works with our biggest borrower and has had about 7 loans with my partner in the past. He's paid all of them on time.

Posted by

Shaun

at

8:41 AM

4

comments

![]()

Labels: Hard Money #28

Tuesday, August 06, 2013

June 2013 Apartment Results

Things continue to look good at the apartment complex in Houston. Occupancy climbed 1 percent to 96%. Total rent collected was almost $165,000 - the highest total since 2009. Total income stayed around $192,000, the amount it's been hovering around since April. Expenses were normal and there were no large, unexpected expenses during the month. The best part is that the net operating income was almost $87,000 for the month and the highest figure year to date. Total cash flow was $19,000 - also a highest year to date figure.

Digging into the details of the financials, I can see rent concessions dropped by $6,000 over May, although write offs of bad debt increased by a similar amount, so that was a wash. Administration expenses dropped by $2,000 and utilities expenses dropped by $3,000. Everything else stayed pretty much the same as in May.

Compared to the budgeted numbers, we are looking good. Our income numbers for the year are $11,000 over budget, expenses are $36,000 under budget, resulting in a net $25,000 income over budget for the year.

Things are looking good and I'm becoming more hopeful that we will be able to sell the property at a significant profit towards the end of this year or beginning of next year.

Posted by

Shaun

at

7:31 AM

0

comments

![]()

Labels: Multi #1

Wednesday, July 03, 2013

May Apartment Update

The May results for the Houston apartment complex are in and the good performance of April has continued through May. Occupancy remained at 94%. Positive cash flow was $8,700, a noticeable improvement over April's $7,500 (which was pretty good itself). There are still some legal issues with some vendors that are increasing the administrative expenses for the month and, once again, management says these are at reduced levels compared to the past and they should be decreasing.

Rent concessions increased by about $4,000 over last month, but the loss due to vacancy decreased by about $7,500. We did have to write off almost $6,000 in bad debt compared to no write-offs last month, but we also recovered $1,000 of bad debt. Our total income was just about $1,000 less than April.

Expenses for marketing dropped, as did those for capital improvements / replacements. This is what drove our bottom line higher than last month's.

We are still running in line with the budget. We're about $3,000 over budget in income for the year and $27,000 under budget for expenses. Unfortunately, we're also $22,000 over budget for capital improvements / replacements. But overall, the property is $8,000 over budget for net income, so I really have no complaints.

Well, that's not entirely true. I do have one complaint. Management seems to be very poor at handling investor's questions via email (or at the very least, at handling my questions). Last month, when I read the news about the ongoing legal costs for vendor issues, I sent them an email asking about how many issues were still outstanding. I got no response. After reading the May results this morning, I sent them another email asking the same question. I'm also somewhat bothered that it appears t be taking longer and longer for them to get the monthly reports out. I believe back when this investment started, the monthly report would be sent out maybe 2 or 3 weeks after the end of the month. Lately, it has been coming 5 weeks or so after the end of the month.

Posted by

Shaun

at

9:19 AM

1 comments

![]()

Labels: Multi #1

Thursday, June 06, 2013

April Apartment Update

I returned from a quick trip to Las Vegas to find the April financials for the apartment complex in my email. Things continue to improve!

Occupancy is up to 94% and the property reached a couple new milestones: we had the highest monthly revenue since September 2009 and the highest net operating income since August 2009. The property had a positive cash flow of $7,500 - this is over twice last month's NOI and management expects this number to continue to increase in the coming months. Rent concessions dropped to the lowest point since January. The increased occupancy translated to the lowest vacancy expense this year. Bad debt losses were zero (!) and we recovered close to $1,000 in previously recorded bad debt.

There were still some expenses due to legal costs incurred from vendor issues when we had to delay payments for several months in 2011 and 2012, but those are greatly reduced from prior months and hopefully, the end of those expenses are in view.

Budget-wise, the property's net income for the year is about $1,500 ahead of budget. Clearly, apartment complex financials are closely tied to the performance of the local economy. That might be stating the obvious, but this whole process has helped me see just how true that is. This is something to keep in mind when investing in apartment buildings.

It's hard for me to believe I've been in this investment for over four years now. If this improvement continues through the rest of the year, I think we'll be on track to sell the property for a nice profit early next year!

UPDATE: Forgot to mention that hard money loan #24 was paid off on May 31st, so that money is waiting for another deal.

Posted by

Shaun

at

2:37 PM

0

comments

![]()

Labels: Hard Money #24, Multi #1

Monday, May 06, 2013

New Loan Started, March Apartment Update

I've started a new hard money loan on a property in Richmond, CA. This is a 4 bedroom duplex, 2 bedrooms and 1 bath on each side. Each unit is 600 square feet for a total property square footage of 1,200 square feet. Each unit has an attached one car garage. There is at least one tenant in the property (my partner was unable to see the interior of either side). The property was built in 1960 and is on a 3,750 square foot lot. There is a train track nearby and my partner said he could hear the train as it went by, but he thinks it might not be audible from inside the property.

Surprisingly, there are several duplex comps within a 1 mile radius. They sold for between $140,000 (REO sale, slightly smaller property) to $215,000. This property was purchased at auction for $176,000. The opening bid was $117,000, so there was a lot of interest in this property and the price was bid up nicely. Our after repaired value estimate is $220,000 with a current value estimate of $170,000. (Yes, our current value estimate is lower than the purchase price.) Our loan is for $120,000, giving us a 71% loan to value ratio based on the current value. We also estimate the units can rent for $700 a month each, which would be a $1,400 monthly income on a $120,000 investment, should we have to foreclose. Not bad. Our borrower is someone we have worked with a couple times before. He has always paid on time. He works for our biggest borrower and is starting to build his own business of rehabbing foreclosed properties. He is personally guaranteeing the loan. I'll refer to this property as Hard Money #27.

In other news, the March numbers for the apartment complex are in. Rent income increased by $2,000, occupancy rose. Total revenue dropped due to lower utility billbacks, and operating expenses declined. All those factors combined to give an increase in Net Operating Income over last February by almost $3,000. Management expects revenue to continue to increase going forward. For the first three months of this year, the property is cash flow positive, although it is still below the budgeted cash flow amount.

Posted by

Shaun

at

8:26 AM

6

comments

![]()

Labels: Hard Money #27, Multi #1

Wednesday, April 17, 2013

Is The Term "Master Bedroom" Politically Incorrect?

I came across this article today that says the term master bedroom is being phased out of real estate listings due to its connotations of gender and race inequalities. It's being replaced with terms like owner's suite or owner's bedroom.

Is anyone else out there noticing this?

Posted by

Shaun

at

1:21 PM

5

comments

![]()

Tuesday, March 26, 2013

March Update

I've been away for a couple weeks on a cruise to Hawaii. Got back and found out my hard money loan #22 finally got paid off. This was 5 months overdue, but since the borrower is one of our biggest clients and he was still making payments on time, we didn't call the note and opted to let him pay it off at his leisure. The property was under contract for sale two or three times, but fell out of escrow each time, I believe because the buyer's lender would not consider this a valid property for a conforming loan. The unit was a triplex and those are normally considered conforming (i.e. non-commercial), but apparently in this post-real estate bubble world, lenders are being more strict in what they define as conforming. Our client ended up keeping the property himself and renting it out. He did a re-fi to pay us off. I'll be adding some money to the principle return from this loan and am looking for a new property to loan on.

My other three hard money loans continue to pay on time.

The financial results for January for the Houston apartment complex came in. The property showed a loss of about $6,500 for the month. This is very disappointing, considering how things appeared to be turning around in December. The silver lining is that the loses in January were due to one-time expenses. We had to pay a vendor almost $4,000 for work done 4 to 5 months ago (we had been delaying paying the vendor until the property's cashflow improved), there was a bed bug infestation that required pest control treatment costing close to $1,000, and several fees related to health and fire permits and loan reserves processing by our lender were paid. We had to replace a hot water boiler that failed, although this $14,000 cost will be reimbursed from our capital improvements escrow account with the lender. If you exclude the boiler and one-time items, cashflow would have been a positive $11,000 for the month.

February's figures should be coming in soon. I'm looking forward to seeing how things went that month.

Posted by

Shaun

at

10:42 AM

0

comments

![]()

Labels: Hard Money #22, Multi #1

Thursday, February 07, 2013

2012 Year End Apartment Update

I'm getting a bit behind the times here, but here's the 2012 year end results for the Houston Apartment complex.

December was another good month for the property as things continued to improve. The property had the highest total income amount for the year at just over $186,000. Operating expenses were a bit on the high end, due to some legal bills over the delayed payments we had over the past year. Even with that, they did not reach the highest monthly expense amount of 2012. These two things resulted in the highest monthly net income for the year. Actually, this is really the highest because we had one month where the figure was artificially inflated due to an insurance reimbursement of $30,000. We had a net income of almost $16,000. This was enough to push the property into the black for the whole year to the tune of about $29,000! This is almost $44,000 ahead of the budget that was given to investors during the cash call at the beginning of the year.

Rents are trending upwards at about 2% annually and our rent concession figure rose only marginally from last month. Losses due to bad debt dropped 40% from last month.

With the improvement in the property's finances and assuming we continue to stay on budget for 2013, management believes we can begin to look at selling the property sometime in early 2014. We're looking to sell in the $15 million range (we bought the property at around $12 million). If this can be done, the annualized return on investment to investors would exceed the 9% we were guaranteed.Looking back, it appears management has a fairly good handle on budgeting and any surprises tend to be on the good side. At the start of the year, their budget called for the property to lose money each month through June and finishing the year with a small loss. In reality, the property ended up losing money each month through May and finished the year with a slight gain.

In other news, my four hard money loans continue to pay on time. One property was up for sale, but that fell though and it looks like now the borrower is going to keep this for himself and convert it to a rental. That loan is close to coming due, so it should be paid off soon.

Posted by

Shaun

at

10:33 AM

2

comments

![]()

Labels: Hard Money #22, Multi #1

Friday, January 18, 2013

How To Read A Property's Financial Statement - Expenses Section

Last week, I looked at the Income section of a multi-unit property's financial statement. This week, I'll look at the Expenses section. This part of the statement is actually the most straightforward - it details all the things that management had to spend money on. Again, these are actual values from the Houston apartment complex, this time or February 2012. Here's the summary:

The first column of figures is for the month of February and the second column is the year to date amount (January and February 2012, in this case).

Later in the report, you'll see each section broken down further:

As you can see, the breakdown gives us more detail into how exactly the money in each category is being spent. For example, the Apartment Turnover figure is broken down into costs for general cleaning, re-painting, and carpet cleaning.

This is all fairly straightforward stuff but I enjoy reading it to get a better sense of where money is being spent.

Posted by

Shaun

at

9:43 AM

2

comments

![]()

Labels: analysis tools, financial statements, paperwork, property management

Friday, January 11, 2013

How To Read A Property's Financial Statement - Income Section

As I was looking over last month's apartment numbers, I realized there was a term on the financial statement that I never really paid much attention to and that some people might not have a good idea of the meaning of. I thought it might be worth explaining how the income portion of a financial statement is filled out and what each term means.

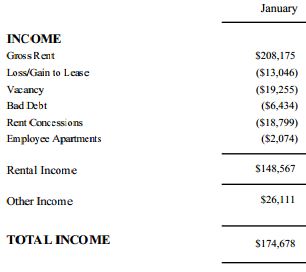

Below is the actual Income portion of the financial statement for the Houston apartment complex for January 2012.

Negative numbers are shown in parenthesis. Let's go over each term.

Gross Rent - This is the amount of rent that would be collected if every unit in the apartment was rented at market rates.

Loss/Gain to Lease - This is the term I figured some people might not know about. Apartments are typically rented out on a 1 year lease. Sometimes longer, sometimes shorter, but typically the tenant signs a contract to pay a certain amount of rent each month for a set number of months. Suppose a tenant signed a lease to pay rent of $500 per month for 1 year and that this is the typical rent for the area at the time of lease signing. Now suppose that after 6 months, due to improvements in the property, a stronger housing market in general, or other factors, the typical rent for a similar apartment in the area rises to $600. At that point, if a new tenant were to rent this apartment, management could charge $600, but since the existing tenant has a contract to pay only $500, the property is losing out on on $100 per month. This is known as "loss to lease" - We've lost $100 in income because the tenant has a 1 year lease preventing us from raising rents. The opposite also applies - if typical rents drop to $400, then we have a "gain to lease" of $100 per month because the tenant is paying $100 more than we could charge a new tenant.

Vacancy - This is pretty obvious. If an apartment is not rented, this is the amount of rent we are losing.

Bad Debt - Income we are owed, but have not been able to collect. For example, if a tenant bounces a check, that rent amount is bad debt (at least until it has been collected).

Rent Concessions - How much we give away in order to get tenants to sign leases. When you see advertisements for apartments that say "First month's rent free!", that is a rent concession and the amount of one month's rent would show up in this category.

Employee Apartments - Managers and / or other building employees sometimes live on site and, in exchange for their services, get either free or discounted rent. This line tracks this amount.

Notice that these amounts, even though they are negative, show up in the Income portion of the financial statement, not the Expenses section. This is because they are not actual amounts we have paid out. They represent reductions in the maximum possible income the property can achieve (as given in the first item, Gross Rents). The Expense portion of the financial statement only contains amount we have actually paid out.

So, as an investor, what you want to see when looking at a property's financial statement is the Gross Rent figure rising and the other figures decreasing (or getting closer to zero). In most cases, the monthly Gross Rent is typically assumed to be static for an entire year, even though market rents may vary month to month. This is just to make budgeting, reporting, and forecasting easier. However, if you are able to look at the financial statements of a property for multiple years, look for this number to be rising each year.

Loss / Gain to Lease is something you want to see approaching zero. A positive number ("gain to lease") is nice in the short term, but that would mean most of your leases are at above-market prices. In turn, that means tenants will probably be moving to a cheaper property when their leases are up and it may be hard to attract new tenants. Here is a chart of the monthly loss to lease numbers for my apartment for this year (through November):

Not too bad. Pretty big losses, but at least it's trending in the right direction.

I hope that gives you some insight into how to read the income portion of a financial statement for a rental property.

Posted by

Shaun

at

9:19 AM

5

comments

![]()

Labels: analysis tools, financial statements, paperwork, property management

Tuesday, January 08, 2013

November Apartment Report

Last month, the apartment complex hit a bit of a rough patch. We saw declining occupancy and increased vandalism. I'm pleased to report that things have improved during November. Occupancy increased and rent concessions decreased, so it appears the new property manager is doing well. We hit our highest monthly total revenue number since June and the third highest for the entire year. This was also an $8,000 improvement over October's figure. Our net income figure also rose to $5,700, which is $1,500 higher than last month and the highest figure of the year.

Expenses continue to be stable and we are almost $4,000 over our monthly budgeted net income figure. Unfortunately, our net income for the year overall is still $45,000 under budget, due to the poor performance during the first half of the year. Next month, our $8,000 reduction in our mortgage payment kicks in, so we should see some really good numbers for December.

Posted by

Shaun

at

9:02 AM

0

comments

![]()

Labels: Multi #1

© 2006 Shaun | Site Feed | Back to top